Broadcom Inc

Fiscal Third Quarter Highlights

For the quarter ended on August 4, Broadcom reported revenue grew 47% YoY to $13.07 billion, surpassing FactSet's and LSEG's consensus estimate of $12.98 billion. When excluding the contributions from VMware deal that closed in November, revenue only grew 4%. Semiconductor solutions brought in $7.27 billion with revenue growing 5% YoY, but still short of FactSet's estimate of $7.42 billion. Strengthened by the VMware deal, infrastructure-solutions reported revenue grew as much as 200%, topping FactSet's consensus estimate of $5.52 billion.

But, Broadcom ended up with a net loss of $1.88 billion, or 40 cents a share.

Adjusted earnings amounted to $1.24, surpassing LSEG's consensus estimate of $1.20.

Guidance In-Line with Expectations

For the current quarter, Broadcom guided for revenue of $14 billion.

Fueled by ethernet networking and custom accelerators for AI data centers, Broadcom lifted its prior forecast as it now expects $12 billion in full-year AI revenue from sold AI parts and custom chips. It previously expected $11 billion. For the full year, Broadcom expects adjusted EBITDA to be 64% of revenue.

Broadcom's Contribution is Not Going Unnoticed

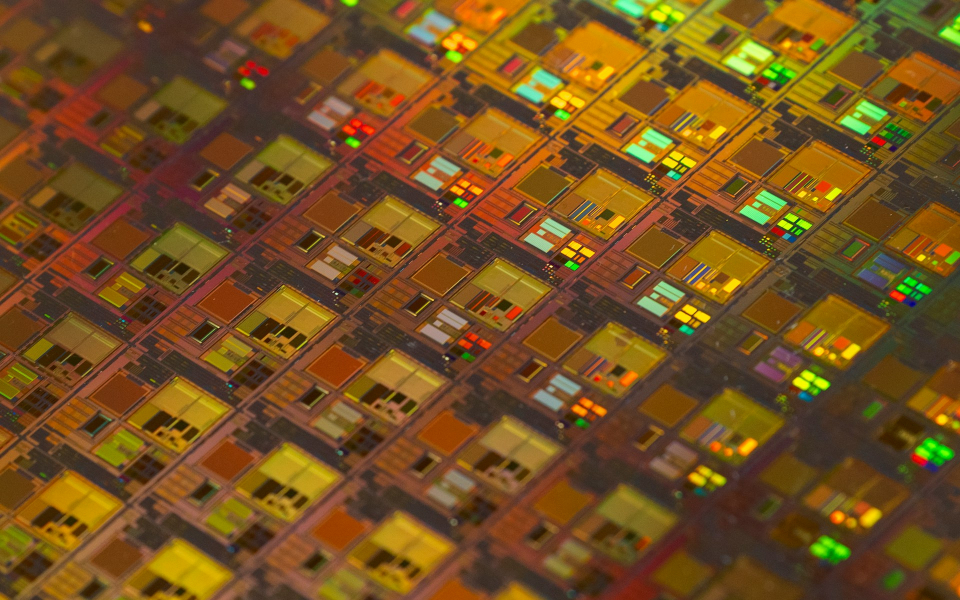

Over the past year, Broadcom stock rose as much as 75%, underlying the fact that the market is seeing the company as a noteworthy contributor to the AI infrastructure in the making. Some example of Broadcom's work is on the Google-made

With this decision, Apple also showed its focus to reduce reliance on the dominating chip player, Nvidia

Therefore, the Apple supplier seems to have a less-obvious but still noteworthy role in the AI dynamics and new era that is in the making and Broadcom is clearly somewhat receiving the acknowledgement for its contribution.