Stocks were mixed on Wednesday, as markets too a breather ahead of another key inflation report due out Thursday morning. The Dow Jones Industrial Average added nearly 38 points, while the S&P 500 Index and Nasdaq Composite lost 0.2% and 0.5%, respectively.

Here's how the market settled on Wednesday:

S&P 500 Index

Dow Jones Industrial Average

Nasdaq Composite Index

Moving Markets: Wall Street came off a winning session on Tuesday after February's consumer price index reading came in-line with expectations. However, investors are growing cautious ahead of the Federal Reserve's upcoming policy decision later this month.

Wolfe Research Chief Economist Stephanie Roth warned on Wednesday that the central bank may lean "a bit hawkish" in March, hampering market optimism that policymakers may begin cutting interest rates in June.

"After two strong CPI prints, we're not convinced the Fed will be ready to cut rates by the June meeting with only 2.5 additional CPI readings from here (May CPI comes out on the 2nd day fo the June FOMC)," Roth wrote. "This would be reflected in the FEd potentially moving its median 2024 dot to two cuts instead of three, although this is not yet our base case."

On the Earnings Front: Dollar Tree

"Our biggest problem right now is getting enough merchandise into the stores fast enough so the consumer can respond," said CEO Rick Dreiling, quoted by Reuters, as the company struggles to compete with rivals such as Walmart

In Single-Stocks News: Tesla

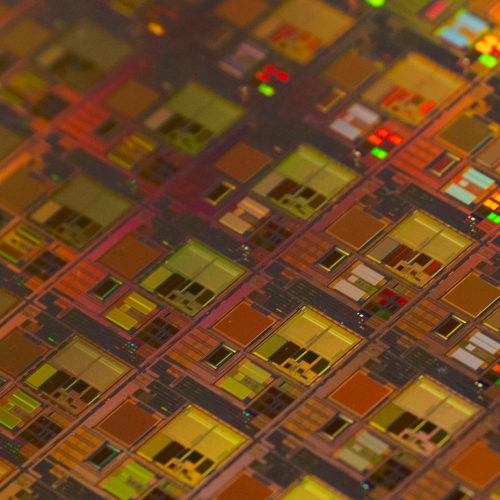

Super Micro Computer

"SMCI's competitive advantages include building block architecture which helps to quickly incorporate new technology and reduce time to market, relationship with leading AI CPU/GPU/ASIC providers including Intel