Due to insufficient government funding, Applied Materials Inc

As of March 29, the Biden administration has decided against financing the construction or refurbishment of semiconductor R&D facilities.

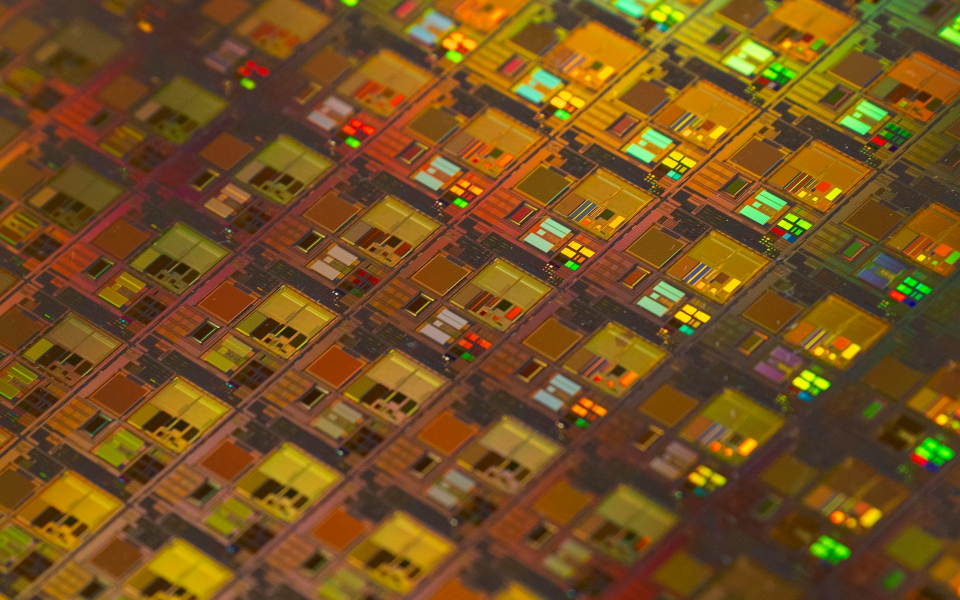

This shift comes amid a global semiconductor shortage that has disrupted supply chains across various industries.

Despite President Joe Biden signing a bill in late 2022 allocating $52.7 billion for domestic semiconductor research and manufacturing, a recent appropriations bill redirected a portion of these funds, impacting Bay Area companies not directly manufacturing semiconductors, the San Francisco Chronicle reports.

California's semiconductor industry, a global innovation leader, faces challenges due to this reallocation. This reallocation affects companies like Applied Materials, Nvidia Corp

Applied Materials had announced in May 2023 plans for a new facility aimed at accelerating semiconductor technology development and innovation, expecting to create thousands of jobs.

However, the lack of federal support jeopardizes this investment, prompting the company to consider relocating the project out of California.

The Commerce Department still intends to allocate $11 billion towards semiconductor manufacturing, but companies like Applied Materials, focusing on R&D without manufacturing, will not qualify for this funding.

The situation is complicated further by ongoing negotiations for fiscal year 2025 appropriations and efforts by California representatives to secure federal investment for semiconductor R&D within the state.

Additionally, Applied Materials is under investigation for allegedly exporting equipment to China's SMIC without proper licenses.

In February, Applied Materials reported first-quarter fiscal 2024 sales of $6.71 billion, beating the analyst consensus estimate of $6.48 billion. The company reported EPS of $2.13, beating the analyst consensus estimate of $1.91.

Applied Materials stock gained over 79% in the last 12 months. Investors can gain exposure to the stock via First Trust Nasdaq Semiconductor ETF

Price Action: AMAT shares are up 0.10% at $209.25 premarket on the last check Tuesday.