A new Biden administration rule that will expand U.S. powers on stopping exports of semiconductor manufacturing equipment from some foreign countries to China will serve as a boon to the industry, according to a prominent tech analyst.

A current Foreign Direct Product rule already gives the U.S. the ability to stop products made from U.S. technology, including those made in a foreign country, from being sold to China.

The White House expects to reveal the new measure in August. It excludes exports from foreign countries that make key equipment, such as Japan, the Netherlands and South Korea, Reuters reported.

It would also prohibit several Chinese companies that play a major role in China's chipmaking efforts from receiving exports from countries such as Israel, Taiwan, Singapore and Malaysia.

"It's bullish for the chip sector and AI Revolution trade because it puts a tight rope around restrictions and tariffs," Wedbush Securities analyst Dan Ives told Benzinga on Wednesday. "It's a huge positive for the supply chain."

Ives is Wedbush's managing director and senior equity research analyst covering the technology sector.

Chinese foreign ministry spokesperson Lin Jian told Reuters that efforts by the U.S. to "coerce other countries into suppressing China's semiconductor industry" undermines global trade and hurts all parties.

Lin added that China hopes relevant countries would resist U.S. efforts and protect their long-term interests.

"Containment and suppression cannot stop China's development, but will only enhance China's determination and ability to develop its scientific and technological self-reliance," Lin told the wire service.

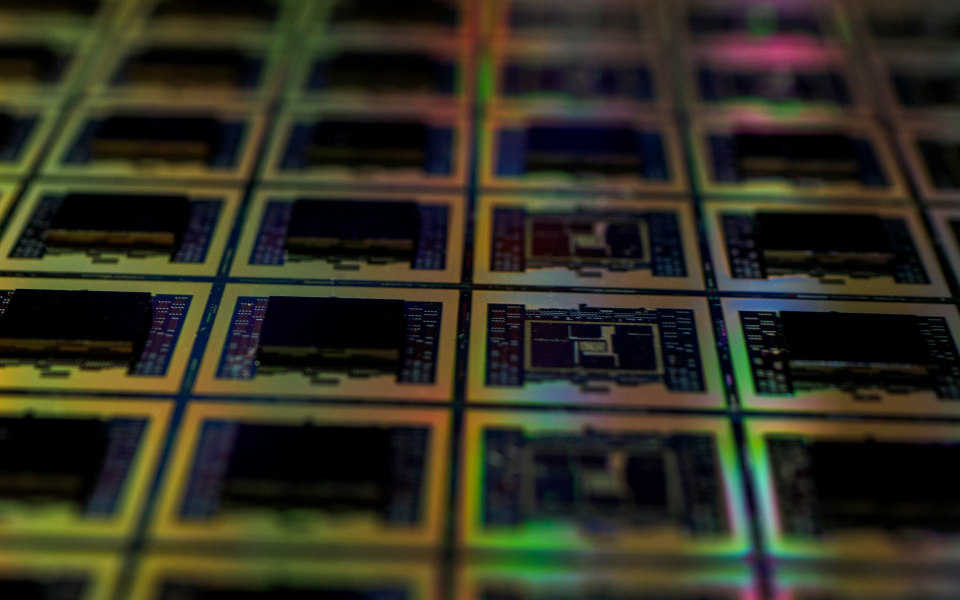

Aiming to impede supercomputing and AI breakthroughs that could benefit the Chinese military, the U.S. imposed export controls on chips and chipmaking equipment for China in 2022 and 2023.

The new rule is currently in draft form. It shows how Washington is seeking to keep up the pressure on China's burgeoning semiconductor industry but without antagonizing allies.

Price Action: New York-listed U.S. chipmakers trended upward as of Wednesday's mid-afternoon trading.