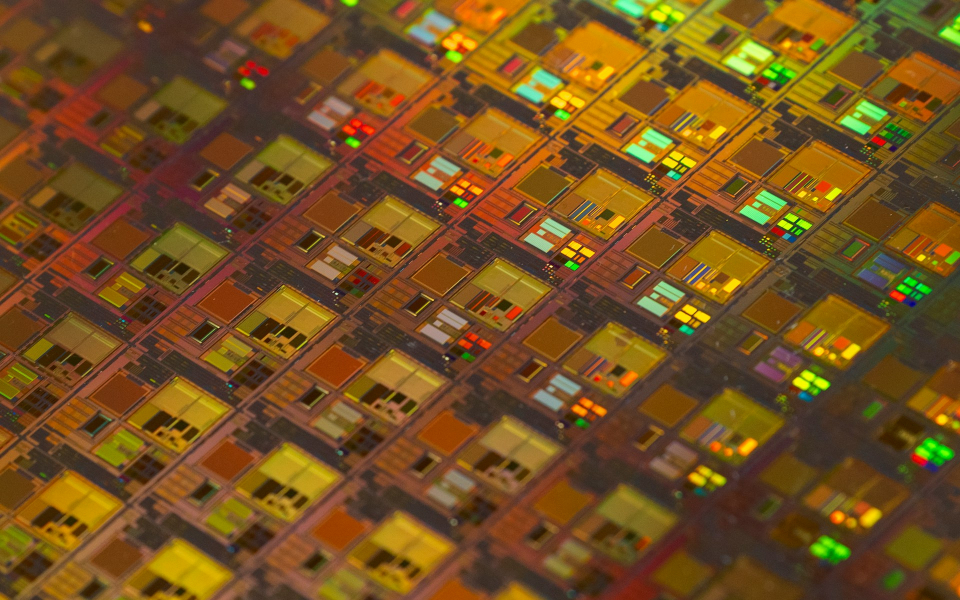

Micron Technology

Over the past year, Micron stock has surged by 97%, and year-to-date it has gained 58%, highlighting its robust performance. Shares were up 4.1% at the time of publication on Monday, signaling continued investor optimism.

Investor Optimism For Micron Stock Boosted By Bullish Indicators

From a technical analysis standpoint, Micron exhibits several bullish indicators.

The stock is currently trading above its key moving averages, suggesting sustained upward momentum. Micron's 8-day simple moving average (SMA) at $124.49, 20-day SMA at $118.47, 50-day SMA at $114.90, and 200-day SMA at $86.03 all signal bullish sentiments, with the current price at $128.09.

This alignment above the short, medium, and long-term moving averages underscores a strong bullish trend.

The Moving Average Convergence Divergence (MACD) indicator, a crucial tool for gauging momentum, stands at 3.70, indicating a bullish signal for Micron.

Additionally, the Relative Strength Index (RSI) at 65.34 - and trending upwards - suggests that the stock is approaching overbought territory (at and above 70). While this typically signals potential short-term pullbacks, the overall trend remains positive.

Bollinger Bands analysis further supports a bullish outlook. The Bollinger Bands range between $106.58 and $130.35. With the current price well within these bands and trading in the upper (bullish) band, Micron stock has positive investor sentiment driving it.

Analysts Are Raising Their Price Targets

Recent analyst updates have also reinforced the bullish sentiment. Morgan Stanley's Joseph Moore upgraded Micron from Underweight to Equal-Weight, raising the price target from $98 to $130.

Mizuho's Vijay Rakesh maintained a Buy rating and increased the price target from $130 to $150. These updates, coupled with the tight supply of high-end memory chips driven by AI demand, bode well for Micron's future performance.

The broader market environment is also favorable. The U.S. government's CHIPS Act, with $32.8 billion in incentives, aims to boost domestic semiconductor production. Micron and other U.S. companies are poised to benefit from these measures, enhancing their competitive edge in the global market.

Micron Technology's technical indicators point to a continued bullish trend. Despite potential short-term volatility, the charts indicate that the stock appears positioned as a compelling investment. The ongoing demand for AI-driven memory chips and supportive government policies further boost Micron's bullish case.