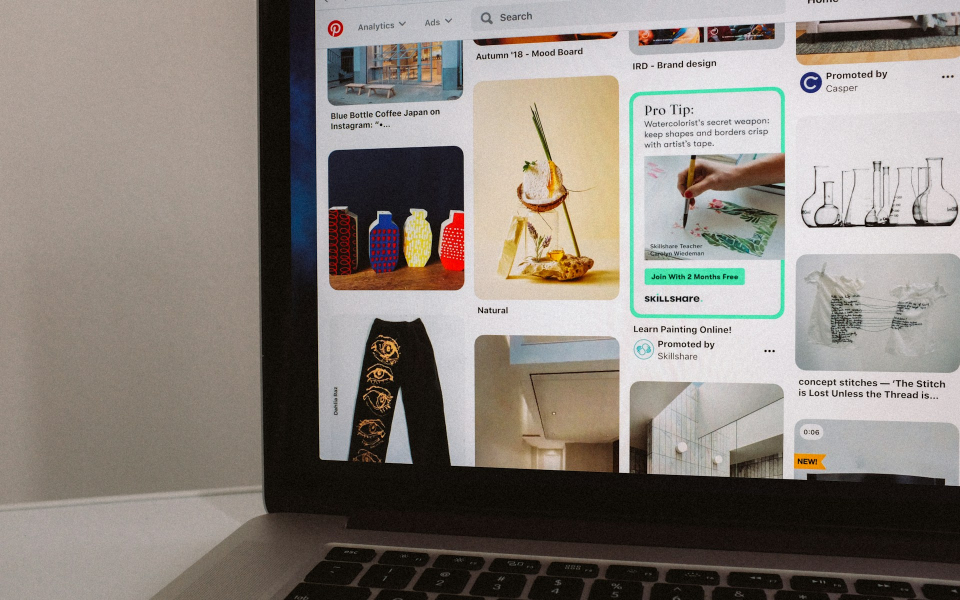

Pinterest Inc

The company offers strong returns on investment to advertisers, according to Oppenheimer. Third-party integrations are also driving improvements to auction density and pricing.

Oppenheimer analyst Jason Helfstein initiated coverage of Pinterest with an Outperform rating and a price target of $45.

The Pinterest Thesis: As users come to Pinterest to search for products and inspiration, they welcome relevant ads, Helfstein said.

This can drive increased engagement and, therefore, more advertisers and higher ad pricing.

Pinterest's 2024 ARPU (average revenue per user) estimate stands at $6.75, significantly below that of YouTube, Facebook and TikTok, indicating that the company "has room to continue growing monetization on ad product improvements, higher engagement, better data and targeting and higher pricing," the analyst stated.

Pinterest's third-party integration via Amazon.com Inc

Pinterest is the fastest-growing digital ad platform outside of Meta Platforms Inc

PINS Price Action: Shares of Pinterest had risen by 0.72% to $30.68 at the time of publication on Tuesday.