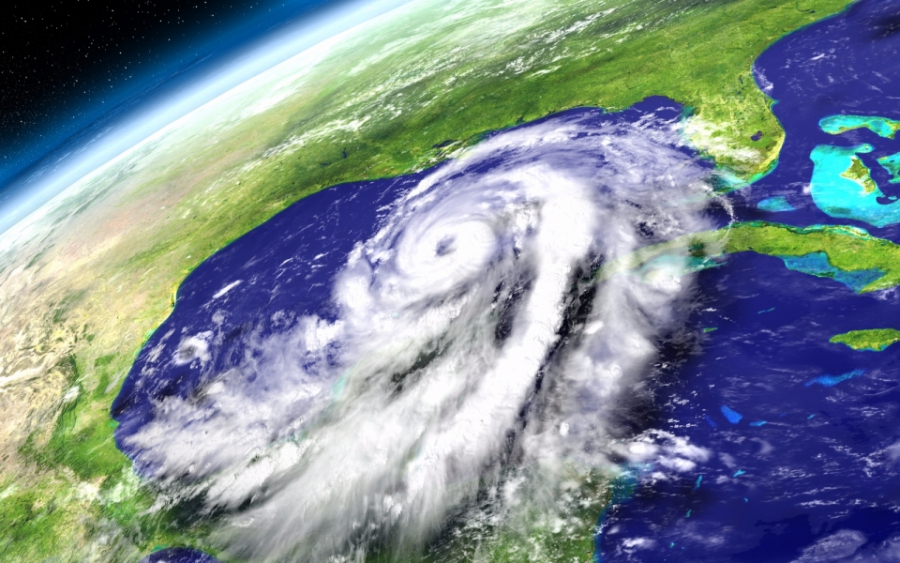

With all the talk of storms hitting the United States lately, you have to wonder who is going to pay for all that damage? Insurance companies are in the business of making a profit and as each storm passes, ridiculously high damage amounts are thrown out. The storm that hit Texas last week is now estimated to cost more than $200 billion. To put that in perspective, Apple (NASDAQ: AAPL) currently has about $262 billion in free cash on hand.

Now, one company will not be asked to pay for all this. There are many insurance companies and they all specialize in one form of insurance or another. But, lets look closely at Allstate (NYSE: ALL), they are mostly known for auto insurance but also provide homeowners insurance as well. They have $482 million on hand at the moment. They are the 4th largest insurer in the property and casualty space, and the second largest in homeowners insurance with a 10% market share. So you can see quickly how one bad storm could bankrupt an insurance company. So how do they constantly avoid corporate disaster when natural disasters strike? They are called Catastrophe bonds.

Catastrophe bonds or more commonly, "CAT" bonds are actual securities that you can invest in that are strictly linked to risk and nothing else. They were the answer to the record damage costs of Hurricane Andrew in the 90's. Insurance companies knew that they would get stuck with more claims to pay out than premiums they could collect so they created Cat bonds.

Here's how they work. Investors can buy these bonds from investment banks or providers. These are considered risky investments so as for the bond ratings you typically see BB ratings or worse. They also tend to have maturity dates of only three years, though many are less than that. Its a black and white bet really. If you buy a Cat bond and no catastrophe happens then you get paid the coupon. If a catastrophe happens then the principal you invested is "forgiven", which is a nice way to say you lose, and the insurance company can use that money towards whatever catastrophe happened. It has been labeled a "great" way for insurers to grow while still diversifying their risk.

Lastly, as with all other products out there, you will likely be seeing an ETF for CAT bonds soon. There is an effort by some to move a product like this into the ETF world, and there are actually a few interesting white papers by some of the leading investment banks. As for all the cat bond investors out there now, let's hope your bonds matured over the summer!